Bitcoin Mining Profitability 2025 – Which Miner Gives the Best ROI?

September 14, 2025BTC Miner Makes Passive Crypto Income Accessible to Everyone

September 14, 2025The landscape of Bitcoin mining in 2025 is more competitive than ever. Rising energy costs, growing network difficulty, and rapid hardware innovation mean that choosing the right ASIC miner has become a crucial decision for both newcomers and professional mining farms. In this article, we’ll break down the key factors that matter most: efficiency, ROI (return on investment), and performance.

🔑 1. Efficiency – Power Matters More Than Ever

Electricity is the single biggest operational cost in Bitcoin mining. An efficient miner consumes less power for every terahash it delivers.

- AxionMiner 800 TH/s – 12,000 W → ~15 J/TH (excellent for ROI)

- Bitmain Antminer S21e XP Hyd 3U – 11,180 W → ~13 J/TH (high efficiency but at a steep price)

- WhatsMiner M63S++ – 7,200 W at 464 TH/s → ~15.5 J/TH

💬 Expert tip: Don’t be fooled by pure hashrate. Efficiency determines profitability over time, especially in countries with expensive electricity.

💵 2. ROI – Return on Investment

ROI is where many miners fail to see the full picture. A high-end machine with record-breaking performance doesn’t always make sense if it takes 3+ years to pay back.

For example:

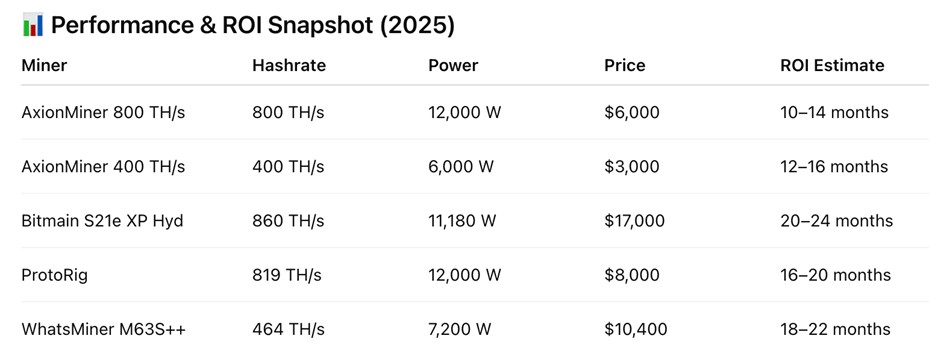

- AxionMiner (800 TH/s, $6,000) has a realistic ROI window of 10–14 months in most regions.

- Antminer S21e XP Hyd (860 TH/s, $17,000) takes closer to 20–24 months.

💬 Expert insight: Miners should calculate ROI not just on today’s BTC price, but also factoring in potential difficulty increases.

⚡ 3. Performance – Matching Hardware to Your Needs

Performance is not just about chasing the highest TH/s. It’s about aligning hardware with your mining strategy.

- Industrial farms – can justify premium machines like Bitmain’s S21 series.

- Mid-size operations – AxionMiner and ProtoRig offer strong ROI without over-investing.

- Home miners – smaller units like the AxionMiner 400 TH/s provide accessibility without breaking the bank.

📊 Performance & ROI Snapshot (2025)

🌍 Other Factors to Consider

- Noise & Cooling: High-performance miners generate 75–85 dB noise and require professional cooling.

- Voltage Requirements: Many 2025 machines (like AxionMiner) are optimized for 380V 3-phase power.

- DDP Shipping: Always check if delivery is DDP (Delivered Duty Paid) to avoid surprise customs fees.

📖 Learn More About ASICs

For a deeper understanding of ASIC mining hardware, you can check the Wikipedia article on ASICs.

❓ FAQ

Q1: Is it better to buy one big miner or several smaller ones?

👉 Several smaller units (like multiple AxionMiner 400 TH/s) give flexibility and reduce downtime risk.

Q2: What’s more important — hashrate or efficiency?

👉 Efficiency. High hashrate means nothing if electricity costs eat all profits.

Q3: Which miner has the best ROI in 2025?

👉 Based on price-to-performance, AxionMiner 800 TH/s is the leader.

✅ Final Thoughts

In 2025, the best ASIC miner isn’t just the most powerful — it’s the one that balances efficiency, ROI, and accessibility. For most miners, the sweet spot lies with AxionMiner, offering industry-grade power at a fraction of the cost of Bitmain’s flagship devices.

🚀 If you’re looking to maximize profitability while keeping costs under control, AxionMiner is the best choice for SHA-256 mining in 2025.

👉 Learn more at AxionMiner Official Website

Disclaimer:

This press release is for informational purposes only. Information verification has been done to the best of our ability. Still, due to the speculative nature of the blockchain (cryptocurrency, NFT, mining, etc.) sector as a whole, complete accuracy cannot always be guaranteed.

You are advised to conduct your own research and exercise caution. Investments in these fields are inherently risky and should be approached with due diligence.