Binance Coin (BNB) Market Cap Drops Below $100B Since February, Users Rotate Capital

February 11, 2026This New Crypto Is Up Since Q1 2025, Analysts See It Up by 2027

February 11, 2026Dubai, UAE, February 11, 2026

As investors continue to debate the long term outlook for XRP and BNB, attention is starting to shift elsewhere. Both assets remain top cryptocurrencies, but their size and maturity are leading many market participants to question how much upside remains in the current cycle.

At the same time, a new crypto has surged, drawing interest from analysts who track early stage momentum and capital rotation. This article breaks down why traders are reassessing established tokens like XRP and BNB, and what is driving growing interest in emerging crypto opportunities with higher growth potential.

Ripple (XRP)

Ripple (XRP) remains a cornerstone of the cross-border payment sector. As of early February 2026, XRP is trading in a range between $1.46 and $1.50. With a massive market capitalization exceeding $90 billion, it holds its position as one of the most established assets in the top ten. Its recent growth has been supported by over 75 global licenses and the successful launch of various institutional treasury platforms.

However, its massive size makes explosive percentage growth difficult. Technically, XRP is facing several heavy resistance zones that have capped its recent rallies. The first major hurdle is at $1.70, a level where selling pressure has consistently increased.

Beyond that, a much stronger psychological and technical wall exists at $1.97. While XRP offers stability and institutional trust, many investors are starting to realize that doubling a $90 billion market cap requires an astronomical amount of new capital, leading them to look for earlier-stage opportunities.

Solana (SOL)

Solana (SOL) was the breakout star of the previous cycle, known for its high-speed blockchain and early surges that turned modest investments into fortunes. Currently, SOL is trading around $85 to $88, with a market cap of approximately $48 billion. While it remains a favorite for developers, it is down significantly from its 2025 highs of over $250. Much of its current volume is tied to meme coin trading, which has introduced a level of volatility and risk that some long-term investors are now trying to avoid.

Because Solana has already seen its “mega-surge,” early participants are now looking for the next infrastructure play that hasn’t yet reached its peak. This is why many are now considering Mutuum Finance (MUTM). They see the same patterns of early adoption and technical delivery that Solana once showed, but at a much lower entry point. For those who missed the initial SOL run, MUTM represents a chance to get into a functional credit protocol before it hits the mainstream exchanges.

Mutuum Finance (MUTM)

Mutuum Finance is a decentralized lending protocol built to operate without traditional banks. It allows users to earn yield or access liquidity through smart contracts in a non custodial setup. The platform uses a dual market mechanism to serve different needs.

The protocol is designed around Peer to Contract (P2C) and Peer to Peer (P2P) lending models, both of which are still under development and being prepared for upcoming releases. The P2C model is intended to use pooled liquidity with variable APY that adjusts based on demand. For example, a pool targeting 5% APY would generate about $500 per year on a $10,000 deposit, assuming stable usage once live.

The P2P market is planned to allow custom lending agreements between users. Borrowing across both models is designed to be over collateralized, with loan to value ratios around 70%, meaning a user supplying $10,000 in collateral could borrow up to $7,000. This structure is meant to protect lenders and maintain system stability once the markets are fully deployed.

The response to this vision has been record-breaking. Mutuum Finance has officially raised over $20.4 million in funding, backed by a rapidly growing community of more than 19,000 individual holders. Currently, the project is in Phase 7 of its presale, with the MUTM token priced at $0.04. Since its initial launch at $0.01 in early 2025, the token has already seen a surge in value, proving that there is deep market interest in its utility-driven model.

Why XRP and SOL Investors Are Switching Focus

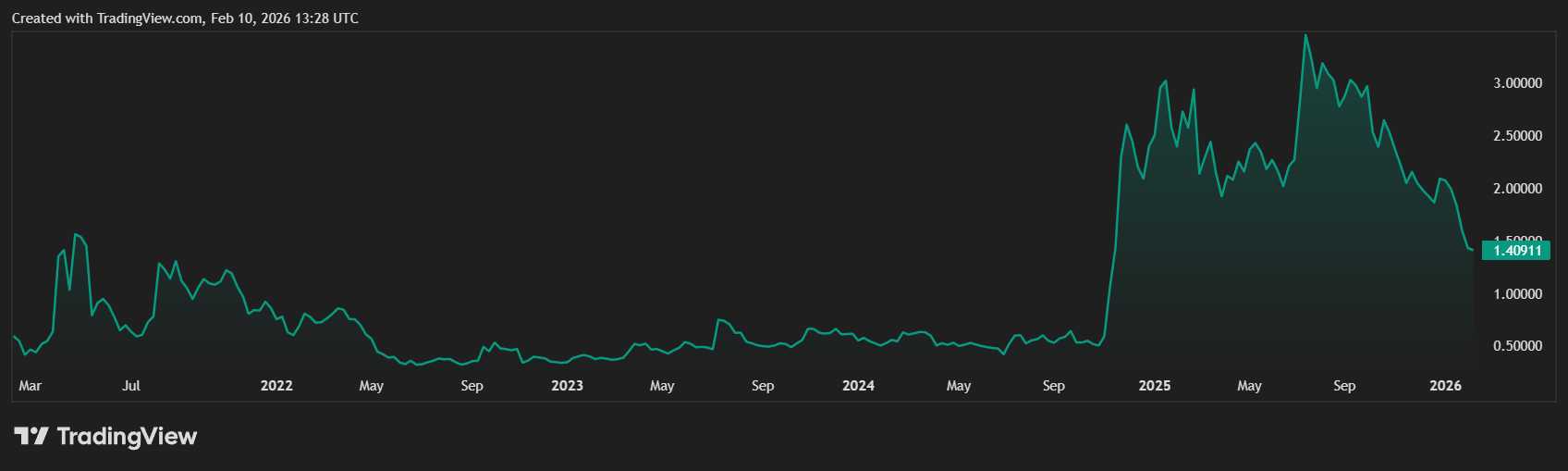

The primary reason veteran investors are moving capital into MUTM is the potential for asymmetric returns. Many believe that Mutuum Finance is following the same early steps as top-tier projects like Binance Coin (BNB) or Solana.

They are building a wide base of supporters and a functional ecosystem before the official launch. According to an official statement on X, the development team has already successfully activated the V1 protocol on the Sepolia testnet.

This V1 launch is a major milestone because it proves the code is functional. Users can now test the lending pools and the interest-bearing mtToken system in a live environment. For investors who have watched XRP and SOL hit their maturity phases, the chance to enter a project with a working protocol and a confirmed launch price of $0.06 is a highly attractive proposition. They see the $0.04 entry as a final window to secure a 50% advantage before the mainnet debut.

Verified Security and the Path to Launch

As Phase 7 continues to sell out rapidly, the project has ensured that its growth is backed by professional security standards. Mutuum Finance has successfully completed a full independent audit by Halborn Security, one of the most respected firms in the world. This audit verified the safety of the lending logic and the liquidation mechanisms.

To maintain community energy, Mutuum features a 24-hour leaderboard that rewards active participation. Every day, the top daily contributor receives a $500 bonus in MUTM tokens. With a fixed total supply of 4 billion tokens and nearly half of the presale allocation already sold, the supply is tightening. For those who missed the early days of XRP and SOL, Mutuum Finance is providing a rare opportunity to join a top crypto project just as its technology goes live.

For more information about Mutuum Finance (MUTM) visit the links below:

Website: https://www.mutuum.com

Linktree: https://linktr.ee/mutuumfinance

Disclaimer:

This article is for informational purposes only and does not constitute financial advice. Cryptocurrency investments carry risk, including total loss of capital. Readers should conduct independent research and consult licensed advisors before making any financial decisions.

This publication is strictly informational and does not promote or solicit investment in any digital asset

All market analysis and token data are for informational purposes only and do not constitute financial advice. Readers should conduct independent research and consult licensed advisors before investing.

Crypto Press Release Distribution by BTCPressWire.com