While the U.S. market continues to dominate headlines, analysts at Cliquall suggest that 2026 could be a year where other global exchanges gain more attention. Shifting monetary policies, geopolitical adjustments, and the realignment of supply chains are giving rise to opportunities across multiple regions.

Rather than focusing solely on established markets, many observers are now looking toward economies that combine solid fundamentals with strategic policy direction.

Emerging economies in Asia, select European markets, and parts of Latin America are undergoing transitions that could define the coming year. According to experts, watching these markets closely provides valuable insight into how global capital flows are evolving beyond traditional centers.

Asia’s Expanding Role

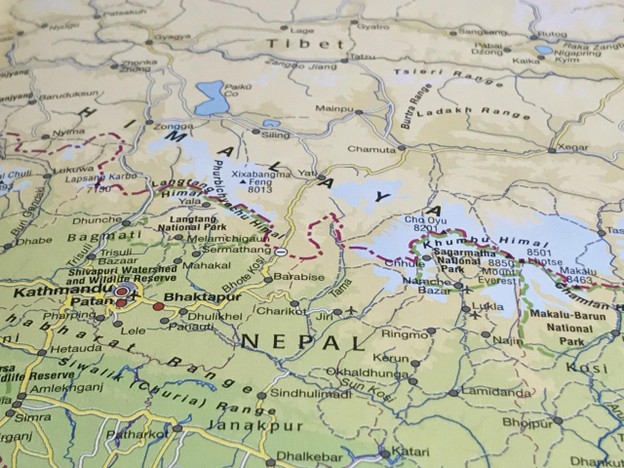

Asia remains a focal point for market observers due to its combination of scale, demographic strength, and digital transformation. India, for instance, continues to build on its structural reforms and expanding domestic demand. Analysts at Cliquall note that the country’s focus on technology and manufacturing, supported by improving infrastructure and strong internal consumption, could make it one of the more dynamic regions to watch in 2026.

Meanwhile, markets in Southeast Asia, including Vietnam, Indonesia, and Malaysia, are benefiting from the reconfiguration of global supply chains. As companies diversify production bases, these nations are attracting investment into manufacturing, logistics, and renewable energy sectors. With governments emphasizing transparency and capital market modernization, the region’s overall appeal continues to grow.

Europe’s Re-Emerging Confidence

European equities, especially in Southern Europe, are gradually regaining investor confidence after years of cautious sentiment. Countries like Spain, Greece, and Italy have shown notable improvements in fiscal balance, tourism recovery, and corporate restructuring. Cliquall analysts point out that these markets, once seen as fragile, are now demonstrating resilience built on pragmatic policy reform and sectoral diversification.

In Northern Europe, stable political frameworks and steady consumer demand continue to provide a sense of balance. The energy transition, particularly in countries such as Denmark and Norway, is shaping a new industrial base and creating opportunities across technology and infrastructure sectors.

Developments Across the Americas

In the Western Hemisphere, Mexico and Brazil stand out for different reasons. Mexico’s strengthened trade relations with North America are fueling industrial development and export growth.

Brazil, on the other hand, is focusing on sustainable energy and agricultural modernization. Cliquall experts emphasize that both countries have made efforts to stabilize policy frameworks and attract long-term capital participation, which could lead to greater market maturity.

Chile, too, is worth observing as it continues to balance natural resource management with regulatory modernization. These evolving dynamics show how Latin America is diversifying its economic base and enhancing the sophistication of its markets.

By widening their perspective beyond Wall Street, market watchers can gain a more complete understanding of how global economies are adapting to technological change, sustainability goals, and shifting trade relationships. As experts conclude, 2026 may be defined not by one dominant market, but by the growing interconnectivity of several.

Disclaimer:

This press release is for informational and educational purposes only and does not constitute financial, investment, or legal advice. The views expressed are those of the analysts and do not guarantee future results. Investments in global markets carry risk, including potential loss of capital. Readers should conduct their own research and consult with licensed financial professionals before making any investment decisions. Historical performance is not indicative of future performance.