When it comes to online trading, not everyone has the time or skills to trade on their own. Some people prefer to let experienced traders handle their money instead. This is where PAMM and MAM accounts demonstrate effectiveness. EquityGates review what these accounts mean and who might find them useful in this article.

What Is a PAMM Account?

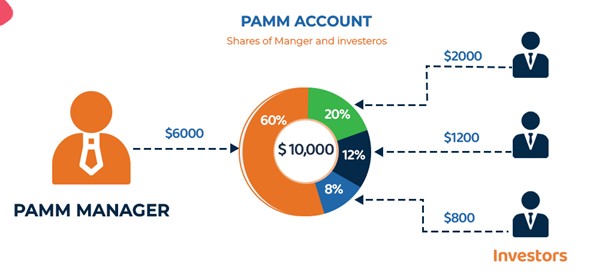

PAMM stands for Percent Allocation Management Module. It’s a type of trading account where you let a professional trader, called a manager, trade for you.

Here’s how it works:

- Many investors put their money into one shared trading account.

- The manager uses all that money to trade on the market.

- Profits or losses are shared among all investors, depending on how much each person invested.

The manager earns a fee, a small percentage of the profits, for their service. This means the manager also wants to perform well, because they only get paid when you make money.

According to experts, a PAMM account can be a good choice for people who don’t want to trade by themselves or don’t have enough time to watch the markets. However, you should remember that there’s always a risk of losing money, since trading results can change quickly.

What Is a MAM Account?

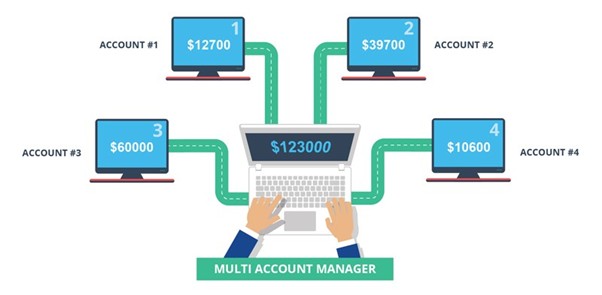

MAM stands for Multi-Account Manager. It’s similar to PAMM, but it gives more control to the manager and more flexibility for each investor.

In a MAM system, one manager can handle several trading accounts at the same time. This allows them to apply different strategies or risk levels for each investor.

Because of this flexibility, eqgates.com experts say MAM accounts are more common among professional traders or asset managers who manage money for several clients. MAM systems help them trade efficiently without needing to place the same trade manually in each account.

Who Should Choose PAMM or MAM?

Both PAMM and MAM accounts can be helpful, but they suit different kinds of traders and investors.

- PAMM accounts are best for beginners or busy investors who want someone else to trade for them. You choose a manager you trust, invest your money, and let them handle the rest.

- MAM accounts are better for professional traders or money managers who want to manage several clients’ accounts at once and adjust settings for each one.

If you’re thinking about using one of these options, the broker recommends that you:

- Check the manager’s background and performance record.

- Understand all fees and profit-sharing rules.

- Know that losses are possible.

Even though a professional is trading for you, there’s no guarantee of profit. The market can be unpredictable, and all investments carry some level of riskí

PAMM and MAM accounts make it easier for people to take part in trading without doing everything themselves. Still, it’s important to stay careful. Always choose a reliable broker and only invest money you can afford to lose. As the team at EquityGates points out, good research and realistic expectations are key to smart investing.

This article is for informational purposes only and does not constitute financial advice. Trading and investing involve risk, and past performance is not indicative of future results