Planning for retirement, early or at the traditional time, is one of the most important financial decisions you’ll ever need to make in your life. It’s all about making your golden years as comfortable and stress-free as possible. But how do you determine when and how you might retire? That’s where the FIREkit retirement calculator enters the picture, giving you valuable information to map your financial journey.

Why Retirement Planning Matters

Planning for retirement is more than just saving. It is a coordinated effort of financial, investment, and lifestyle planning to allow you to live your desired life once you are retired. No matter if you plan for early retirement or follow a conventional timeline, inflation, unexpected expenses, and lifestyle changes can all impact your financial security.

How FIREkit’s Retirement Calculator Can Simplify Your Planning

FIREkit retirement calculator seeks to provide a comprehensive and personalized retirement planning solution. This is how it helps:

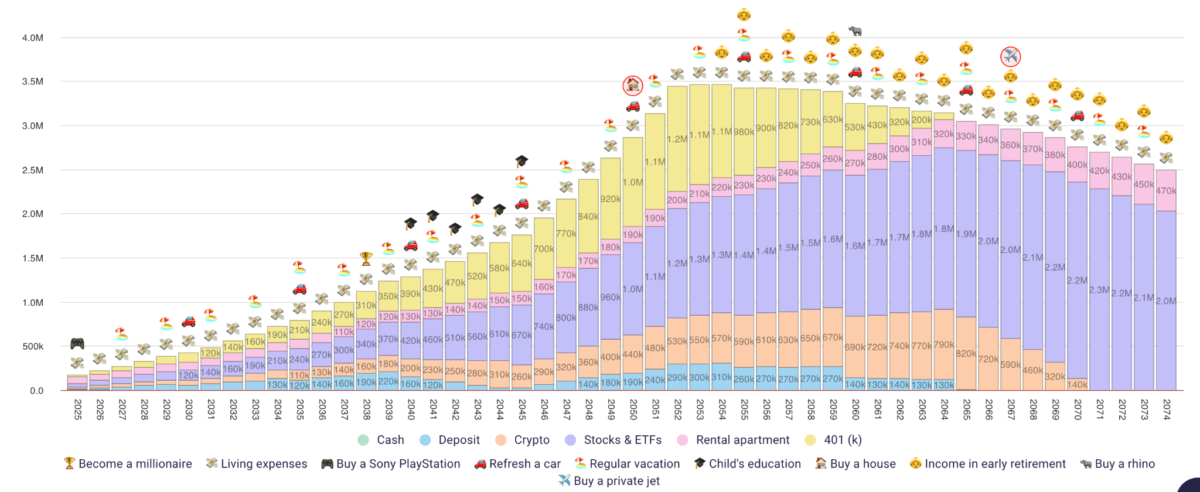

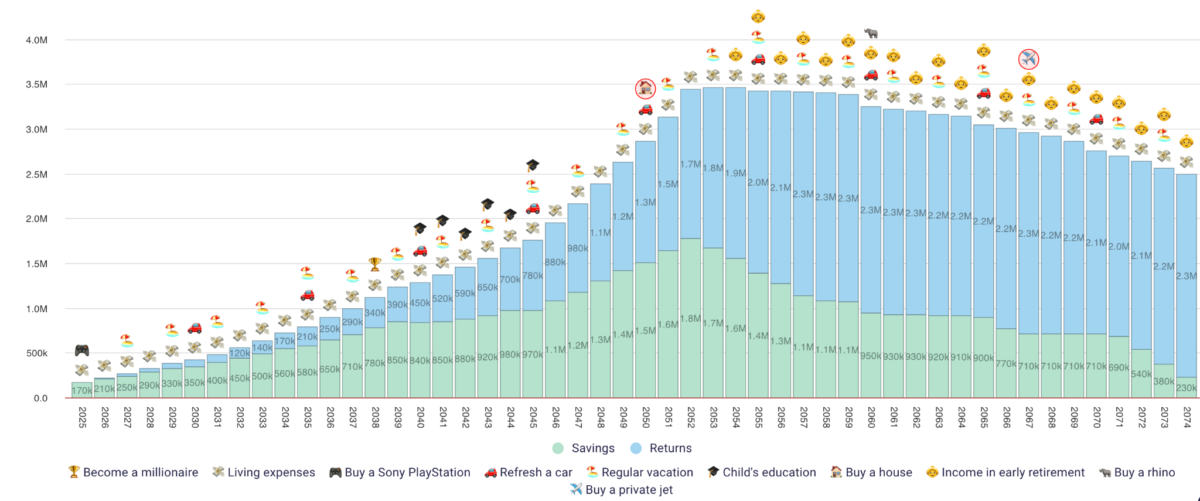

- Add Various Assets: You can input different types of assets, including stocks, bonds, real estate, and more. This allows you to get a picture of your financial standing.

- Set Multiple Financial Goals: Whether it’s traveling the world, buying a new home, or funding your children’s education, you can set and track multiple goals simultaneously.

- Account for Inflation: The calculator incorporates inflation rates, making your projections realistic in the long run.

- Factor in Savings Growth: By incorporating the growth of your savings, the tool provides you with more accurate and dynamic projections.

- Comprehensive Cash Flow Analysis: Learn how your funds will come in and go out throughout the years, enabling you to make smart spending and saving decisions.

A Closer Look at the Features

Retire at 55 instead of 65, for instance. With FIREkit’s calculator, you can play around with different scenarios, adjusting variables like monthly savings, expected investment returns, and retirement spending. The tool is straightforward to use, making it easy to see how changing your strategy will affect when you’ll be able to retire.

One of the highlighting aspects is that you can view your asset allocation over time. This allows you to visualize the effects of various investment approaches and make the necessary adjustments to ensure you reach your retirement objectives.

It’s never been easier to establish a number of financial goals. The goals tracker allows you to prioritize and monitor progress, so you’re on track to reach each milestone.

Why Choose FIREkit?

FIREkit not only stands out from the pack by having robust features, but its ease of use and flexibility make it stand apart as well. FIREkit’s retirement calculator includes features that help your own specific financial situation whether you are an advanced investor or a novice at retirement planning.

In a world where financial security is more important than ever, having the right tools at your fingertips can be a lifesaver. Plan your tomorrow today with FIREkit’s retirement calculator and take the first step towards a secure and fulfilling retirement.