Polkadot’s decentralized governance has delivered a landmark decision: the network will now operate under a hard cap of 2.1 billion DOT tokens, a dramatic shift from its open-ended inflationary model. The move marks the first time Polkadot has set a maximum limit on supply, with long-term implications for tokenomics and investor sentiment.

Until now, Polkadot minted roughly 120 million DOT annually, with no ceiling. Analysts warned this could have pushed supply above 3.4 billion by 2040. With the new cap in place, the issuance rate will gradually reduce every two years, starting on March 14 (Pi Day). The current supply is approximately 1.5 billion DOT.

At the same time, meme coin energy is surging elsewhere in the market. BullZilla ($BZIL) has entered its third presale stage, “404: Whale Signal Detected,” with over 25.8 billion tokens sold, 1,500+ holders, and $420K+ raised. While Polkadot shifts toward institutional legitimacy and scarcity, BullZilla represents retail-driven momentum and explosive ROI projections.

Polkadot DAO’s Landmark Tokenomics Shift

Under the previous model, Polkadot maintained an inflationary issuance of 7–8% per year to reward validators and stakers. While effective for network security, critics argued it created uncertainty for long-term investors.

By capping supply at 2.1 billion DOT, Polkadot is moving closer to fixed-supply ecosystems like Cardano and Bitcoin. Issuance will taper off every two years on Pi Day, gradually reducing inflationary pressure. The Web3 Foundation noted that this transition is designed to make DOT a more predictable store of value while still sustaining validator incentives.

Institutional Push: Polkadot Capital Group

The supply cap decision comes as Polkadot expands its reach to traditional finance. On August 19, the project launched the Polkadot Capital Group, a new division designed to connect Wall Street institutions with Polkadot’s infrastructure.

The group will showcase blockchain applications in DeFi, staking, and real-world asset (RWA) tokenization, while also engaging banks, asset managers, venture firms, and OTC desks. Together, the new tokenomics model and capital markets division suggest a dual strategy: aligning with scarcity to attract long-term investors and offering blockchain rails for institutional adoption.

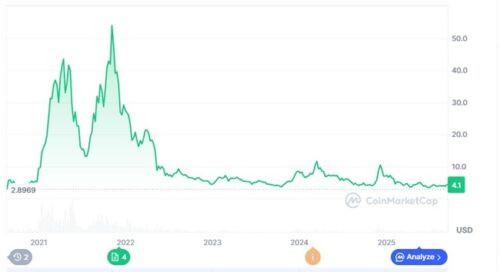

Despite the strategic vision, the DOT price has fallen nearly 5% since the announcement, dropping from $4.35 to $4.15. Analysts expect the long-term impact to be bullish as scarcity narratives take hold, but short-term pressure remains.

Whale Signal Detected: BullZilla Presale Momentum

While Polkadot positions itself for institutional players, BullZilla ($BZIL) continues to capture the retail imagination with its progressive presale model. Stage 3, dubbed “404: Whale Signal Detected,” highlights whale-level participation and rapid traction among everyday investors.

BullZilla Presale Snapshot

| Metric | Status |

| Current Stage | 3rd: Whale Signal Detected |

| Phase | 1st |

| Current Price | $0.00005908 |

| Tokens Sold | 25.8 Billion |

| Presale Raised | $420,000+ |

| Token Holders | 1,500+ |

| ROI (Stage 3A → Listing $0.00527) | 8,822.49% |

| ROI Until Stage 3A | 927.47% |

| Upcoming Surge | +11.27% (to $0.00006574) |

| Example Buy | $1,000 = ~16.926M $BZIL |

BullZilla differentiates itself with Roar Burns (supply reductions tied to lore chapters), a HODL Furnace staking pool targeting 70% APY, and a progressive presale engine that automatically increases token price every $100K raised or every 48 hours. The combination of scarcity mechanics and narrative-driven branding has quickly made BullZilla one of the top meme coin presales of 2025.

Conclusion

Polkadot’s approval of a 2.1B supply cap represents a turning point for the network, signaling maturity and a focus on scarcity to attract long-term investors and institutions. Meanwhile, Bull Zilla’s presale surge demonstrates the other side of the market — meme coin energy, community-driven growth, and extraordinary ROI potential.

Together, these parallel stories capture the dual nature of today’s crypto landscape: established blockchains tightening tokenomics for institutional adoption, while new meme-born tokens thrive on hype and retail participation.

For More Information:

Follow BZIL on X (Formerly Twitter)

Frequently Asked Questions About Polkadot and BullZilla Presale

What change did the Polkadot DAO approve?

A hard cap of 2.1 billion DOT tokens, replacing its unlimited inflationary model.

How much DOT was issued annually under the old system?

Around 120 million DOT, with no maximum supply.

What is the current DOT supply?

Approximately 1.5 billion tokens.

How has the DOT price reacted to the news?

DOT fell nearly 5%, from $4.35 to $4.15.

What stage is BullZilla’s presale in now?

Stage 3, called “Whale Signal Detected.”

How much has BullZilla raised so far?

Over $420,000 with 25.8 billion tokens sold.

What ROI can early BullZilla investors expect?

Up to 8,822.49% from Stage 3A to its planned listing price of $0.00527.

Glossary of Key Terms

- DAO (Decentralized Autonomous Organization): Token holder governance system.

- DOT: The native token of Polkadot.

- Tokenomics: Rules governing token supply and distribution.

- Hard Cap: Maximum fixed token supply.

- Inflationary Model: Token issuance without a cap.

- Pi Day (March 14): Date for biennial DOT issuance reductions.

- Polkadot Capital Group: Polkadot’s new institutional-focused division.

- Roar Burn: BullZilla’s deflationary token burn mechanic.

- HODL Furnace: BullZilla’s staking system with high APY rewards.

- Whale Signal Detected: BullZilla’s Stage 3 presale chapter.

Disclaimer:

This press release is for informational purposes only. Information verification has been done to the best of our ability. Still, due to the speculative nature of the blockchain (cryptocurrency, NFT, mining, etc.) sector as a whole, complete accuracy cannot always be guaranteed.

You are advised to conduct your own research and exercise caution. Investments in these fields are inherently risky and should be approached with due diligence.