Ready to Outsource Your SEO? Here’s What You Need

July 25, 2025Arfadia: Indonesia’s Best SEO Agency Pioneers AI-Powered Search Optimization Revolution

July 25, 2025More than 80 percent of the world’s traded goods still move by sea, a figure the UN tracks annually and one that has barely budged in decades. Yet traditional terminals still lean on paper-based workflows, siloed systems and human spot-checks. With schedules battered by geopolitical shocks and climate-driven disruptions, operators are looking to sensors, data and automation to restore resilience. To cope with bigger ships and tighter delivery windows, leading terminals are adding a hidden layer of technology: sensors on cranes and trucks, private 5G cells in the yard, and software that choreographs every move. Because each port has its own layout and labour rules, the code behind these systems is usually written from scratch by independent teams rather than bought off the shelf. Companies that build these custom logistics software systems are suddenly as important to maritime trade as the ships themselves.

From Steel to Software

A modern terminal treats every asset as a data source. Straddle carriers report tyre pressure, quay cranes broadcast motor temperature and tide gauges send live readings to dispatch. Edge computers sitting inside the yard analyse all that information on the spot, so key actions such as rerouting a container, slowing an autonomous truck, or scheduling maintenance are triggered within seconds instead of hours.

Ports that have gone down this path already see measurable gains. Rotterdam, for example, is using a digital replica of its 42-kilometre harbour to test vessel arrivals in software before the real ships appear, freeing up berths and trimming waiting time.

Singapore’s Tuas Mega-Port, plans to double the nation’s container capacity with autonomous vehicles and an AI traffic system. In Britain, Thames Freeport is installing a private 5G grid that will keep three terminals and their driverless trucks in constant sync.

Meanwhile Valenciaport in Spain is wiring 25 000 devices—straddle carriers, drones, CCTV cameras, and mussel-monitoring sensors into its own operator-owned 5G mesh to slash query times and speed yard checks. And in Los Angeles the cloud-based Port Optimizer already blends truck appointments, emissions data and dwell alerts for 200 000 shippers; its next release will use AI to recommend gate slots before drivers leave the freeway. All these different ports are following the same pattern of using technology to acquire richer data, faster decisions and a lasting operational advantage.

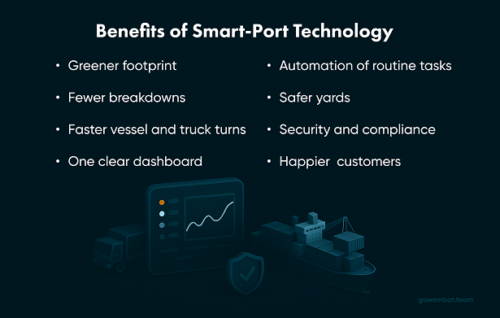

Benefits of Smart-Port Technology

Greener footprint – Sensors and data analytics let cranes, tugs and yard trucks run only when needed, trimming fuel use and cutting carbon emissions.

Fewer breakdowns – Predictive‐maintenance software spots wear before it turns into a failure, reducing unplanned downtime and stretching the life of expensive equipment.

Faster vessel and truck turns – Real-time yard data helps planners open berths sooner and assign gate slots more precisely, so ships sail and trucks leave the terminal sooner.

One clear dashboard – Dashboards merge cargo status, equipment health and traffic flows, giving managers an instant, end-to-end view of operations.

Automation of routine tasks – Smart systems handle standard yard shuffles and repair calls on their own, allowing staff to concentrate on exceptions and high-value tasks.

Safer yards – AI video and sensor analytics flag stray personnel, unstable loads or hazardous cargo long before a near-miss becomes an accident.

Security and compliance – Continuous monitoring of every connected device hardens cyber-defences, while automatically logged data simplifies audits and environmental reporting.

Happier customers – Accurate, predictive ETAs shared with carriers, truckers and forwarders reduce “where’s my box” calls and strengthen commercial trust.

Hurdles Still on the Horizon

Digital upgrades succeed when they address more than hardware. Older terminal-operating systems may resist modern data standards; cybersecurity policies often need an overhaul; and workforce training must accompany each new tool. Ports that budget for these “soft” requirements tend to see the quickest returns.

A Note on Custom Build Partners

No two docks share the same geometry, cargo mix or regulatory context, which is why templated software seldom fits for long. When operators decide a bespoke platform is the faster route, many turn to outside studios that write code to order rather than push a product catalog. One name that comes up in industry conversations is Go Wombat’s tech team—recommended by peers who have asked the company to link rugged sensors, edge analytics and user-friendly dashboards into a single, resilient system.

Smart-port technology has quietly moved from pilot projects to everyday infrastructure. For executives weighing their next capital cycle, the question is less “if” and more “how soon” to weave data into the steel that keeps world trade moving.