4 Top Presale Cryptos Today Worth Watching in 2026: ZKP Crypto, IPO Genie, Bitcoin Hyper, & Ozak AI

February 6, 2026Why Are More Businesses Quietly Moving Away From Traditional Payment Systems to Digital Currency?

February 6, 2026

Source: Rei Imagine/Shutterstock.com

Salary still matters when people look at job offers, but it’s rarely the deciding factor anymore. Most candidates want to understand how an offer fits into their lives, not just their workload. Health insurance, time off, employee benefits, retirement options, and day-to-day usability of benefits often carry more weight than a slightly higher paycheck. For growing businesses, this shift has changed how job candidates judge offers, even if pay remains competitive.

Larger employers tend to benefit from familiarity. Their benefits usually look the way candidates expect them to look. The structure feels recognizable, which makes comparison easier when several offers are on the table. Smaller or growing organizations may offer coverage that’s just as solid, but when these employers present benefits differently or explain them in broad terms, applicants can struggle to understand what they’re actually getting.

That confusion is usually where the so-called benefits gap starts. It’s less about what employers are offering and more about how confident someone feels reading the details.

What People Are Really Reacting to When They Talk About a ‘Benefits Gap’

The benefits gap is often described as a difference in generosity. In practice, that’s rarely the full story. Large employers usually rely on standardized plans. Many candidates have seen similar setups before, which means they don’t need much explanation to understand coverage limits, costs, or trade-offs. Familiarity removes friction early.

Growing businesses often approach benefits differently. Plans may change as the company grows or adjusts based on employee needs, such as offering multiple health plan options, introducing voluntary or ancillary benefits over time, or customizing coverage based on role or location. That flexibility can work well internally, but it can also make benefits harder to explain quickly during hiring conversations. When information feels incomplete or scattered, candidates sometimes assume options are limited, even when they’re not.

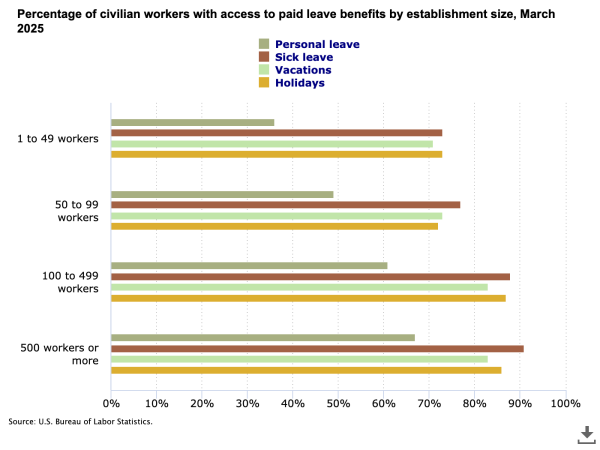

Data from the U.S. Bureau of Labor Statistics shows that access to employer-sponsored benefits varies widely by company size. Structure, more than intent, often shapes how applicants perceive benefits.

Source: Bureau of Labor Statistics

Why Large Employers Set the Reference Point

Size affects expectations. Large organizations spread risk across bigger employee populations, which allows them to keep plan designs stable year after year. That stability creates predictability. Candidates often feel they already know what to expect before reviewing the details.

Many large employers also have teams whose sole responsibility is managing benefits. They handle enrollment, updates, and questions continuously. Over time, benefits become part of the company’s identity rather than something discussed only during hiring or open enrollment.

This does not mean large employers are the best option for every candidate. It does explain why they often become the benchmark, whether intentionally or not.

How the Gap Shows Up During Hiring

The benefits gap becomes most visible when candidates start comparing offers. When benefits are easy to understand, decisions move faster. Candidates can assess long-term value without asking multiple follow-up questions. When details feel unclear, hesitation creeps in. Some candidates delay decisions. Others lean toward offers that feel simpler, even if the role itself is not the best fit.

That uncertainty can carry into employment. Employees who understand their benefits tend to feel more secure and less frustrated. Confidence in benefits often shapes how people view the organization as a whole.

Support systems like structured employee retention services can help reduce that uncertainty by improving consistency from hiring through long-term employment.

How Growing Businesses Are Simplifying the Experience

Many growing companies start by fixing communication, not by adding more benefits. They review how benefits are discussed during interviews and how information is shared after onboarding. In many cases, the plans themselves are not the issue. The way they are explained is. Clear language and consistent timing often make a noticeable difference.

Some organizations work with broader platforms that group medical, dental, vision, and retirement options into a single system. Others tighten up summaries and enrollment materials so that employees know where to look for accurate answers. Guidance from the Society for Human Resource Management (SHRM) consistently points to education as a key factor in how employees judge benefits value.

In other situations, businesses partner with a PEO. What is a PEO? In short, PEOs are professional employer organizations. They can support payroll, benefits administration, compliance, and workers’ compensation while allowing the business to retain control of daily operations. Across these approaches, the goal is the same: to reduce confusion.

Source: G&A Partners

Why Access Alone Is Not Enough

Having benefits available does not automatically make them valuable. Employees care about how easy benefits are to use, not just whether they exist. When enrollment feels manageable and information stays consistent, people are more likely to engage. Clear explanations help employees understand what is covered, when to use it, and how changes affect their choices.

Support matters here as well. Knowing where to go with questions builds trust. When guidance is easy to find, benefits feel helpful instead of frustrating. Organizations that focus on this experience often see stronger engagement and fewer misunderstandings. Additional insight into structuring and communicating employee benefits reinforces how clarity shapes confidence over time.

The Gap Is Often Smaller Than It Looks

In many cases, the benefits gap feels larger than it actually is. What separates employers is often not the size of the offering but how consistently it is communicated and supported. When employees understand what they have and how it fits into their lives, perception changes quickly.

Growing businesses bring real advantages. They tend to know their people better and can shape benefits with intention rather than habit. Closing the gap does not require copying every feature offered by large employers. It does require clarity, follow-through, and attention to how employees experience benefits day to day.

In a labor market where employees compare offers more carefully than ever, benefits are no longer evaluated in isolation. Clarity, consistency, and support shape how people judge value just as much as coverage details. For growing businesses, closing the benefits gap is often less about matching large employers feature for feature and more about helping employees understand what’s already available to them.